The science behind Botik strategies

Welcome to our platform.

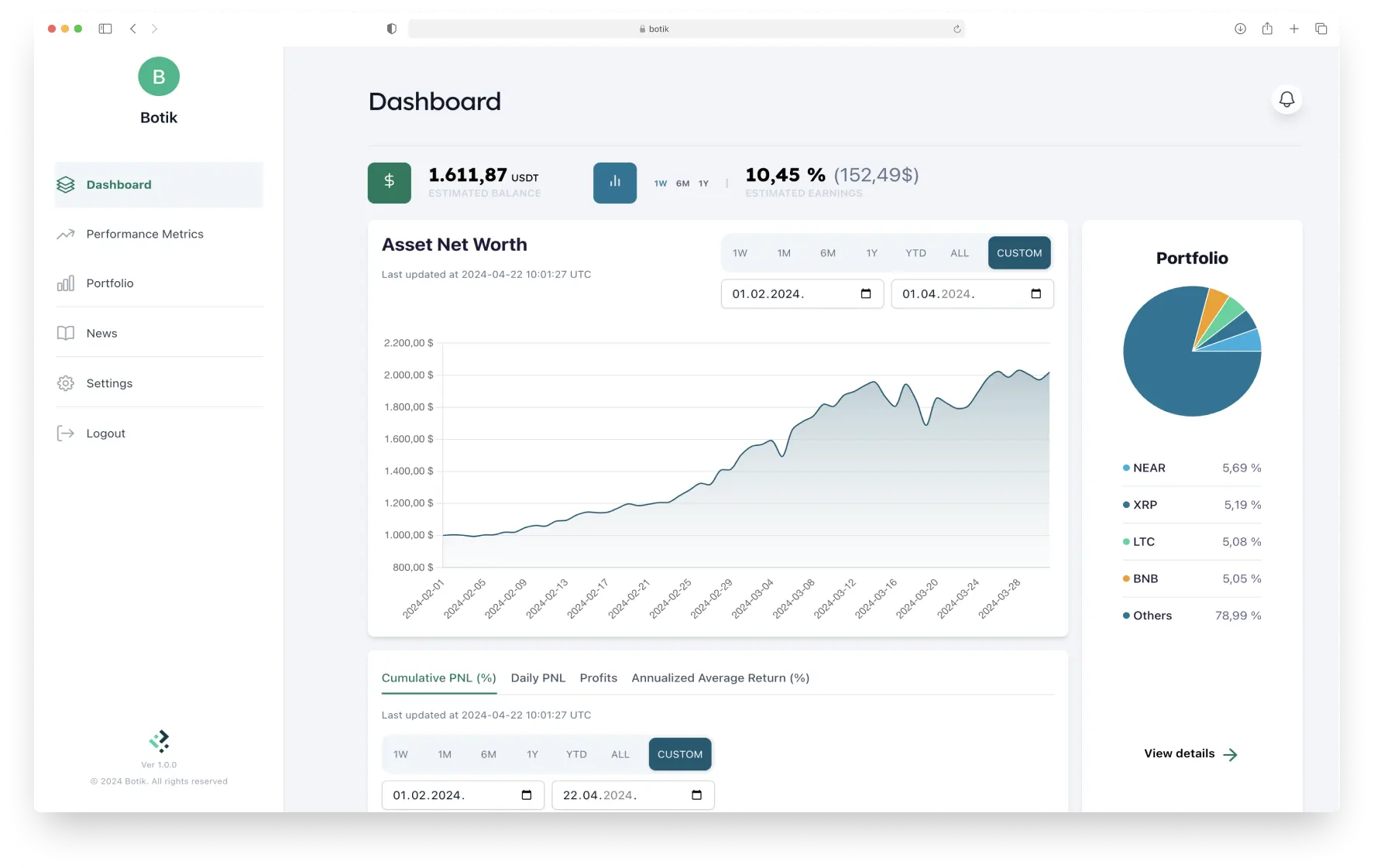

On this platform we present various quantitative investment strategies developed and adapted exclusively for the cryptocurrency market. The platform provides an easy way to choose and activate one of the offered strategies on the account of a particular cryptocurrency exchange.

Depending on the approach used during their creation, strategies are classified into three main categories: Optim, Hybrid and TA Systems. Optim strategies aim to optimize the portfolio by maximizing the ratio of expected return and risk taken. Hybrid strategies combine portfolio optimization with systematic risk management and control properties, and TA Systems strategies are based on technical analysis and signal trading method.

Developed strategies take into account the latest findings of recent scientific research, some of which have been replicated and discussed on our Blog. In further reading, you can find our thoughts and discussion on some aspects of the overall cryptocurrency market, investment opportunities and our project in general, in order to better understand the complex world of cryptocurrency investments.

Cryptocurrencies can be viewed as a new type of digital asset that does not fall into any of the existing definitions and classification categories of financial instruments. The open source feature has also contributed to the rise of a great number of new technology companies that base their business idea on the practical application of distributed ledger technology. Such companies financed their initial development by issuing new cryptocurrencies adapted to their business philosophy. The practical implementation of blockchain technology on the one hand and the positive reaction of the public to the idea of transparency and decentralization on the other hand, contributed to the creation of supply and demand conditions and thus created a new primary cryptocurrency market. The development of the primary market has led to an increase in the number of exchanges that enable active trading of cryptocurrencies, thus creating a completely new self-sustainable ecosystem of the primary and secondary market of new digital assets - cryptocurrencies.

Cryptocurrencies cannot be linked to the framework of fundamental and systematic factors of existing financial instruments of the traditional capital market. Due to the lack of strictly defined fundamental indicators, supported by the results of research by the academic community, considering cryptocurrencies as investment opportunities can put investors in a situation of complete uncertainty. Cryptocurrencies and their entire technical infrastructure are still somewhat unknown to the general public. Due to this, investors have to rely on sometimes biased information gathered through various media platforms. However, regardless of the type of assets and the mentioned shortcomings, when constructing a portfolio, investors should consider the returns dynamics of potential portfolio components in order to identify and quantify the assumed investment risk and define the expected return.

The cryptocurrency market involves significant risks and it is burdened by the absence of a regulatory framework. In addition, a mathematical expression has not yet been derived to calculate at least an approximate intrinsic or fundamental value that would serve as a stabilizer of the price momentum of a particular cryptocurrency. If, from one point of view, there are assets that have been traded on some form of market for more than ten years, and from the other point of view there is no stronghold of fundamental value that would justify their price, one cryptocurrency can be expected to double in one day, but also lose most of its value. Accordingly, in order to assess risk, it is primarily necessary to define variables that could in theory affect the market value of cryptocurrencies, and only then examine and study hypotheses of their causal relationship. After that, taking into account these new insights, one can approach the construction of the portfolio in order to try to stabilize its risk by testing and modeling the quantitative strategy.

The dynamics of change in the value of the cryptocurrency market can be justified through several theoretical assumptions. The first is that it is influenced by some other fundamental, technical and systematic factors that have not yet been defined and examined and therefore remain unknown. There are only a few recent papers that link the price of cryptocurrencies and certain technical properties as systematic factors. The second is that the cryptocurrency market depends solely on the state of mind of investors who base their positions only on technical analysis. And the third is that the value of the cryptocurrency market is defined with the existing state of the traditional capital market. Given that cryptocurrencies are new digital assets that cannot be linked to the framework of fundamental indicators of existing financial instruments, on this website we will formally identify, present and describe portfolio performance with various optimization objectives developed specifically for the cryptocurrency market, taking into account recent scientific research and achievements.

Investing is a risky process that involves exposing to the market changes through the assets in which you invest. Each investment implies a certain degree of risk, and whether the observed investment is suitable for the investor depends on the concordance of his risk preference and expected return with the risk and expected return of the observed investment. Therefore, the ultimate goal is to achieve a return on invested capital which, in the domain of its tolerance and risk aversion, satisfies the expected premium for the assumed risk. The former implies that regardless of the type of asset, when constructing a portfolio, investors should consider the dynamics of the returns of the selected portfolio in order to identify and quantify the assumed investment risk. As compensation for the higher risk taken, the investor should also achieve a higher expected return. The described relation can be viewed as a problem of investing, and it is always associated with various forms and sources of risk from which it can be concluded that when investing we are actually talking about the problem of decision making. This problem can be addressed by qualitative, but also by numerous quantitative approaches in which uncertainty and realized return are explicitly determined and quantified as risk and expected return, and thus taken into the further decision-making process. Every rational investor will strive to invest in those assets that maximize its expected utility. Although only as a conceptual formulation of investor behavior, the assumption is that utility preference is the final result of a number of constraints that an investor may encounter. Accordingly, during the development of our strategies, with the aim of risk management, the latest tools for modeling and qualitative and quantitative data processing were used, which provide the possibility of implementing constraints that increase the aforementioned expected utility.

In theory, investors using different strategies try to create a portfolio with a return higher than the market return in equilibrium. Such an approach involves searching for undervalued assets, which results in an efficient market whose value reflects all relevant and available information related to individual assets. However, for the market to be in equilibrium, there would have to be a consensus on the expected return of the assets to which the funds are allocated. The presence of consensus implies the existence of a fundamental value of that asset. In addition, an efficient market implies the existence of a significant relationship between information and the price of assets, which currently cannot be said for the cryptocurrency market. Therefore, it can be said that the process of finding undervalued or overvalued assets in the cryptocurrency market is even more difficult, because there is neither a market consensus on strictly defined expected rates of return, nor a market in equilibrium that reflects all available relevant information without large price movements. However, regardless of all of the above, the cryptocurrency market and its entire infrastructure is continuously growing. There is a rising number of institutional and individual investors of different profiles who invest and trade in cryptocurrencies, which is why there is an even greater need for new quantitative strategies presented on our platform, in order to define investment opportunities, but also the associated risks.

The strategies are the result of collaboration between three scientific disciplines: data science, quantitative finance and algorithmic trading (signal based quantitative strategies). For the construction of the portfolio, new trading systems have been created that include various methods and algorithms for creating and backtesting strategies, through a complementary approach of technical analysis and portfolio theory that determines the initial components of the portfolio. Defining initial components of the portfolio is a demanding and dynamic learning process that requires continuous monitoring of cryptocurrency market dynamics in order to identify the market regime and calibrate the required concordance of risk and return of a particular strategy. Due to the absence of statistically significant systematic and fundamental factors and indicators, building process of our strategies is carried out through several steps. In the first step, data science serves as a tool for cleaning and preparing data for the implementation of filters based on technical indicators. After the initial data processing and implementation of the filters, in the second step variables of interest are included in quantitative techniques in order to define their expected return, but also the risk if so defined by the strategy. Quantitative techniques may include various machine learning algorithms and trading signals systems for learning and testing models in order to define potential components that correspond to the chosen strategy. In the third step portfolio optimization techniques are applied to define the final components of the portfolio, using the most suitable optimization methods and solvers. For the Hybrid strategies there is one more step in which the dynamic of the market and the portfolio is continuously monitored from the aspect of technical analysis. This is achieved with signal based quantitative strategies for exogenous risk management. The last presented component is extremely important in terms of securing the assets of the portfolio from unwanted shifts in the systematic factors of the cryptocurrency market, and it can be found in recent research on investment opportunities in the secondary market of cryptocurrencies.

An important component in the strategy building process is the parameterization of each individual strategy that most closely matches the optimization goal, as well as the goal of the expected performance. Parameterization is carried out through in-sample and out-of-sample backtesting, in order to create an environment that evokes the dynamics of real market movements the best, thus additionally testing the robustness of the strategy. For the purpose of testing strategies, special applications are developed, adapted exclusively for our needs. If necessary, the parameterization of the strategies is carried out on created synthetic instruments that represent the returns of the user's portfolio, all with the aim of defining the best value of the parameters necessary for the implementation of the strategy. When modeling strategies, all professional recommendations are respected, and all biases such as look-ahead bias are excluded, in order to achieve and present the objective results of a particular strategy.

To implement the reallocation and/or rebalancing of the user's portfolio in accordance with the results of the strategy, autonomous algorithms for the execution of trade orders were created, all with the aim of increasing security and user experience. Changing the weights or components of the portfolio is carried out through the so-called hidden orders where the user's total assets are distributed according to the optimization results through multiple small segments which are sent to exchanges as individual orders, thus ensuring additional anonymity in the market when buying or selling large amounts of cryptocurrencies.

The process of defining potential components of the portfolio represents an important role in the overall process of developing our quantitative strategies. Although the mathematical algorithms used to develop quantitative strategies are sufficient to create a profitable strategy that achieves an expected return higher than the expected market return, special attention is paid to adequate initial selection of potential portfolio components, as a crucial element in the construction and optimization of cryptocurrency portfolio. In order to achieve the best possible results during the portfolio optimization, potential components of the portfolio must be carefully selected in accordance with the objective of the strategy. Defining the potential constituents by considering the fundamental determinants and expectations of the project that issued the cryptocurrency contributes to the overall expected performance of the strategy. The selection of the components is continuously monitored by Botik management before each portfolio reallocation and rebalancing.

The cryptocurrency market is relatively new and it is characterized by high volatility, but also by constant and significant change in cryptocurrencies that make the market. Except for a few cryptocurrencies that are considered an investment opportunity simply because of their longer existence, each market cycle provides an opportunity to invest in cryptocurrencies issued by startups with new technological achievements in the field of distributed ledger technology. The above can be a problem when modeling an individual strategy, therefore, we pay special attention to objective measurement of the performance of our strategies. For this purpose, we have decided that bitcoin (BTC), as the first cryptocurrency with the highest market capitalization at the moment, represents the only relevant benchmark against which we will compare the results of the backtest of our strategy. In addition to a visual comparison of the dynamics between the cumulative return of BTC and an individual strategy, the performance measures include all standard absolute and relative performance measures, in order to additionally and objectively show the advantages of our strategies compared to the benchmark.